January 01st, 1970

More News

More News

November 06th, 2025

September 16th, 2025

March 17th, 2025

February 04th, 2025

January 14th, 2025

January 03rd, 2025

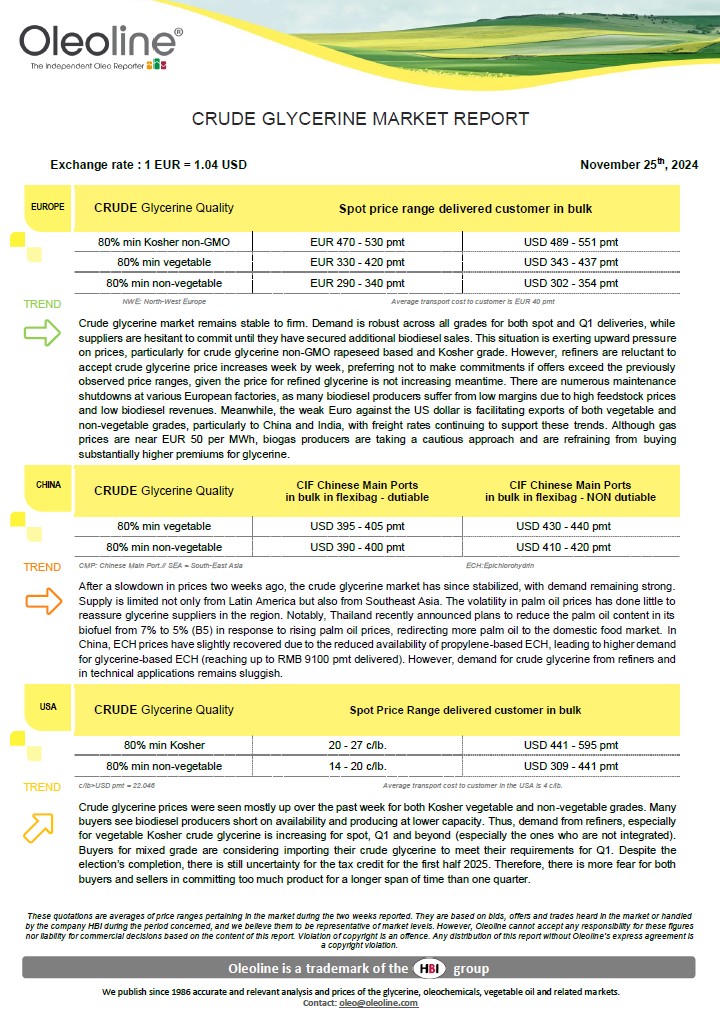

December 03rd, 2024

October 10th, 2024

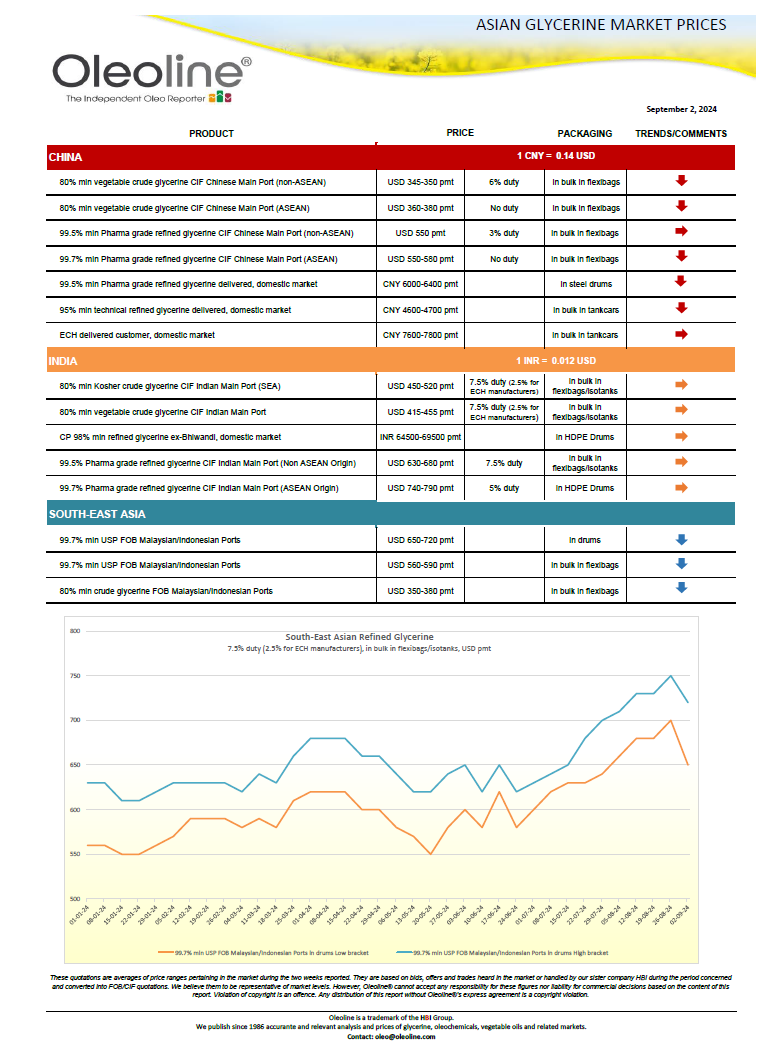

September 03rd, 2024

June 11th, 2024